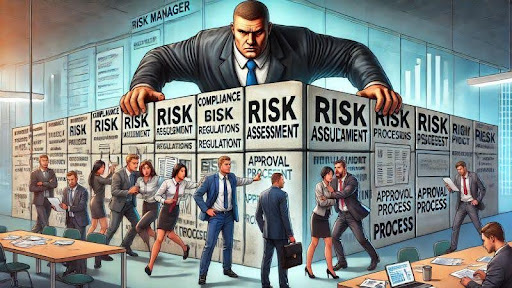

Risk managers are often perceived as “blockers,” but in reality, they should be playing a crucial role in adding value to the business. They should be facilitating a balance between risk and reward, ensuring that opportunities are not stifled by excessive caution.

Effective risk management can lead to better decision-making, cost reduction, business continuity, operational efficiency, stakeholder confidence, competitive advantage, and legal compliance, ultimately enhancing the organization’s performance and long-term sustainability.

In the past six months, there has been considerable discussion within the risk management community about being labeled as “blockers” by the business sector. Is this a fair characterization?

If risk management is intended to be a strategic enabler that increases the likelihood of success, why then are we perceived as impediments? If we are not aiding the business in growth through intelligent risk-taking and decision-making based on risk, then what is our true purpose? Are we here merely due to regulatory requirements? Are we serving only the Board’s interests?

As a risk manager, do you feel you are adding value to the business? If so, in what ways are you contributing? How do you aid in the business’s growth? How do you influence decision-making and strategic planning? If you are not engaged in these activities, what is preventing you from doing so?

If you are part of the business, do you view risk managers as contributors to added value? What is your perception of them? Do you consider them as “blockers,” or do they play a different role? What actions would you like risk managers to take more frequently? Can you cite instances where risk managers have played a beneficial role in the process? Do you find value in various risk processes, such as the RCSA?

I am eager to hear your thoughts. It’s time for a critical examination of our role as risk managers. It’s time for some of us to stop ignoring the obvious and confront serious questions about our function within the business. Merely existing for regulatory compliance is insufficient. If we do not adapt, our roles may soon be supplanted by artificial intelligence.